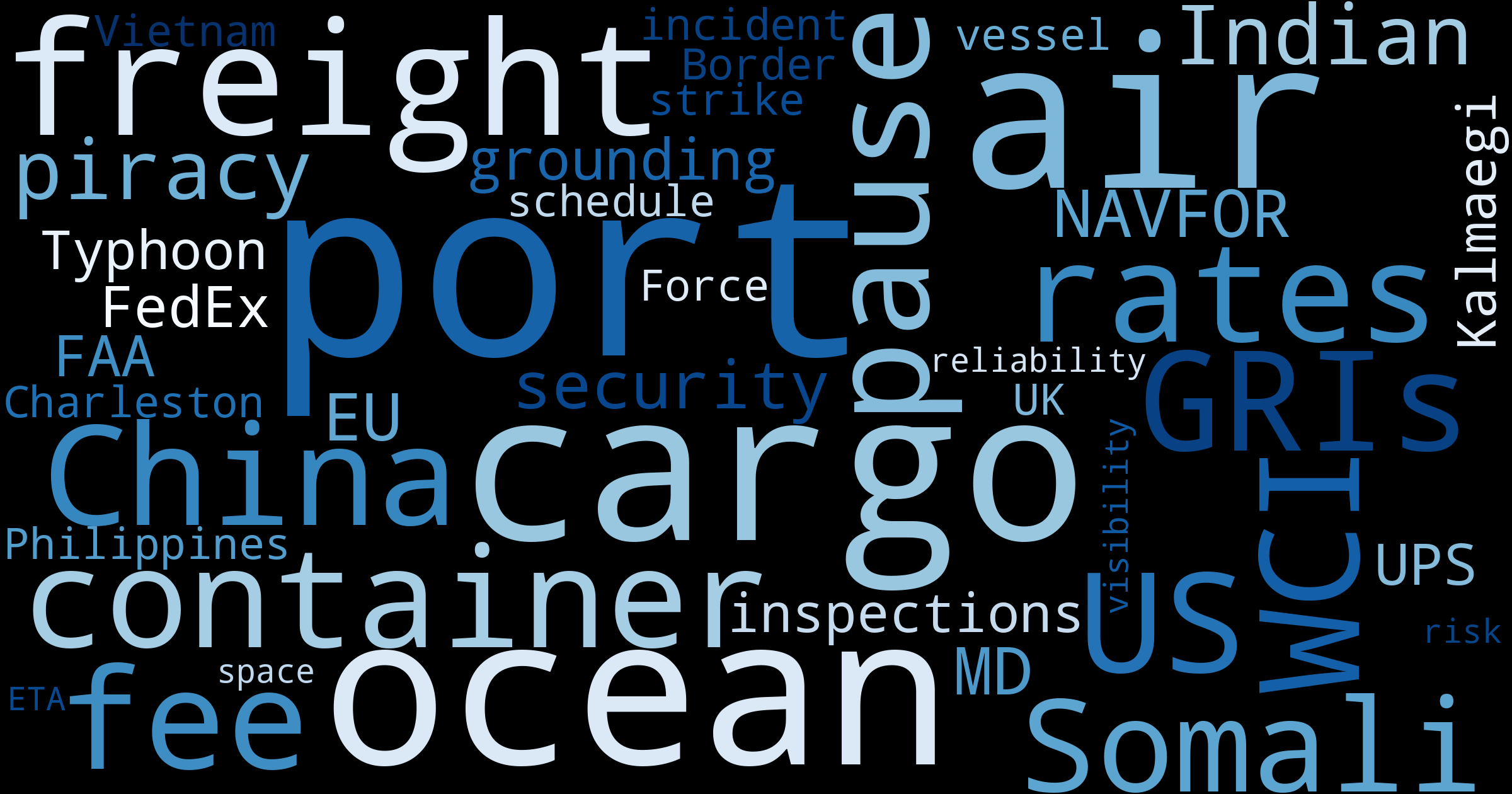

🧭 TL;DR (WEEK OF NOV 3–10, 2025)

- Air capacity risk from MD-11 groundings: Following the UPS crash, the FAA grounded MD-11 freighters for inspections. UPS and FedEx also halted MD-11 operations. Expect short-term network adjustments and potential peak-hour shifts.

- Somali Basin piracy flare-up: The tanker Hellas Aphrodite was boarded far offshore and later secured by EU NAVFOR. Risk remains elevated for transits 300–600 nm off Somalia.

- US–China port fee pause kicks in Nov 10: One-year suspension of Section 301 port fees and reciprocal measures begins. Expect billing reversals, contract updates, and pass-through adjustments.

- Weather and incidents: Typhoon Kalmaegi disrupted port ops in the Philippines and Vietnam. A Maersk vessel off Charleston reported a cargo hold fire with localized impact only.

📊 Maritime Mood Index

Score: 5.8 / 10 — Mixed signals. Security risk higher in the Indian Ocean. Air networks face capacity friction. Policy pressure eased by the port fee pause.

- Security Risk (↑): Coordinated Pirate Action Groups using motherships pushed attacks far offshore. High-risk transits continue around 300–600 nm from Somalia.

- Rate Dynamics (→): Ocean pricing steady to soft with cautious demand. Air spot pressure may tick up where MD-11 lift is material.

- Operational Disruptions (↑): Weather impacts in Southeast Asia and isolated vessel incidents in the US Southeast add planning friction.

- Policy Pressure (↓): US–China port fee suspension starts Nov 10. Watch invoice corrections and refund guidance.

- Innovation Momentum (→): Network optimizations continue at major carriers. No structural tech shifts this week that change near-term planning.

Interpretation: Expect workable ocean capacity with lingering volatility from security and weather. Air planners should validate overnight uplift options while MD-11 inspections proceed. Finance and logistics teams should reconcile port fee pass-throughs and update accruals this week.

🚨 Top Headlines to Watch (Nov 3–10)

| Theme | Key Development | Operational Relevance |

|---|---|---|

| Air Cargo Capacity | FAA grounds MD-11 freighters for inspection. UPS and FedEx pause MD-11 flying. | Recheck lane-by-lane uplift plans. Shift time-critical cargo to alternative frames or routings. Validate night windows where restrictions do not apply. |

| Maritime Security | Hellas Aphrodite boarded then secured by EU NAVFOR. Multiple approaches reported in the basin. | Register transits with MSC-HOA, sail in IRTC where possible, increase speed and watchkeeping. Review BMP5 and citadel readiness. |

| Trade Policy | US–China Section 301 port fee suspension effective Nov 10 for one year. | Audit recent invoices and credits related to the US–China port fee and follow carrier guidance on reversals. |

| Weather | Typhoon Kalmaegi disrupts ports in the Philippines and Vietnam. | Expect late pickups, feeder knock-ons, and rolled cargo. Add yard and dray buffers for affected gateways. |

| Vessel Incident | Maersk ship anchored off Charleston after a cargo hold fire. | Localized schedule checks only. Minimal wider network impact expected. |

📊 Market Movements

Benchmarks are aligned to their native publication days. Use them as directional guides, not one-to-one comparables.

- WCI composite: $1,959/FEU (+8% WoW) [Nov 6]

- Shanghai → Los Angeles: $2,647/FEU (+9% WoW) [Nov 6]

- Shanghai → New York: $3,837/FEU (+8% WoW) [Nov 6]

- Shanghai → Rotterdam: $1,962/FEU (+9% WoW) [Nov 6]

- Shanghai → Genoa: $2,111/FEU (+8% WoW) [Nov 6]

- SCFI composite: 1,495.10 (−3.59% WoW) [Nov 7]

- CCFI composite: 1,058.17 (+3.6% WoW) [Nov 7]

- BAI00 global air index: +2.4% WoW [to Nov 3].

Expect local tightness where MD-11 inspections remove overnight lift.

Regional Port Conditions

| Port/Region | Trend | Driver | Takeaway |

|---|---|---|---|

| Philippines, Vietnam (central and south) | Temporary slowdowns | Typhoon Kalmaegi | Expect feeders and yard ops to normalize in coming days. Keep missed-slot contingencies. |

| Charleston, US | Isolated disruption | Single-vessel cargo fire | Check ETAs on affected service only. No broad port closure signal. |

| UK Borders | Potential delays ahead | Planned Border Force strike Nov 14 | Advance docs and shift arrival times to avoid strike windows where possible. |

⚠️ Operational Disruptions

Indian Ocean High-Risk Area

Multiple long-range approaches and one confirmed boarding were reported. EU NAVFOR intervention secured the boarded tanker. Threat level remains elevated for slow or low-freeboard vessels far offshore.

- Status: Offshore approaches reported 300–600 nm from Somalia. One boarding secured.

- Driver: Organised Pirate Action Groups using hijacked dhows as motherships.

- Action: Register VRS, follow BMP5, maintain higher transit speeds, and keep AIS use consistent with guidance.

Air Network Watch

MD-11 inspections create a moving target for overnight uplift. Carriers are backfilling with other types where available. Cargo impacts vary by lane and time window.

- Status: UPS and FedEx paused MD-11 operations while the FAA directive is in place.

- Driver: Safety inspections after the UPS accident.

- Action: Split routings for urgent freight. Confirm cutoffs and recovery windows with integrators and NVO air desks.

🛠 Innovation & Infrastructure

No structural tech news this week that changes short-term planning. Continue to watch carrier network efficiency programs that can reduce transit variability without adding capacity.

Convert weather holds and security alerts into clear exceptions, use TRADLINX to notify teams before deadlines slip.

📚 Sources & Reference Links

- FAA grounds all MD-11 freighters for inspection — FreightWaves – Nov 9, 2025

- UPS and FedEx halt MD-11 flying — FreightWaves – Nov 8, 2025

- Hellas Aphrodite crew rescued — Marine Log – Nov 7, 2025

- Somali piracy risk rising — Splash247 – Nov 7, 2025

- US–China one-year suspension of port fees — WorldCargoNews – Oct 31, 2025

- Drewry — World Container Index weekly update (Nov 6, 2025)

- Shanghai Shipping Exchange — SCFI official page

- TAC Index — Baltic Air Freight benchmarks and weekly movement

- Industry split on fee pause — Global Trade Magazine – Nov 9, 2025

- Matson paid 6.4 million in Chinese port fees — MarineLink – Nov 4, 2025

- Typhoon Kalmaegi port impacts — Container News – Nov 9, 2025

- Maersk vessel fire near Charleston — gCaptain – Nov 7, 2025

- UK Border Force strike plan — MarineLink – Oct 31, 2025

Why overpay for visibility? TRADLINX saves you 40% with transparent per–Master B/L pricing. Get 99% accuracy, 12 updates daily, and 80% ETA accuracy improvements, trusted by 83,000+ logistics teams and global leaders like Samsung and LG Chem.

Prefer email? Contact us directly at min.so@tradlinx.com (Americas) or henry.jo@tradlinx.com (EMEA/Asia)

![[Logistics Alert] Italy’s Unannounced Strike + South Asia Port Aftershocks](https://blogs.tradlinx.com/wp-content/uploads/2025/12/Naples-Port-Stock-Image-1.jpeg)

Leave a Reply