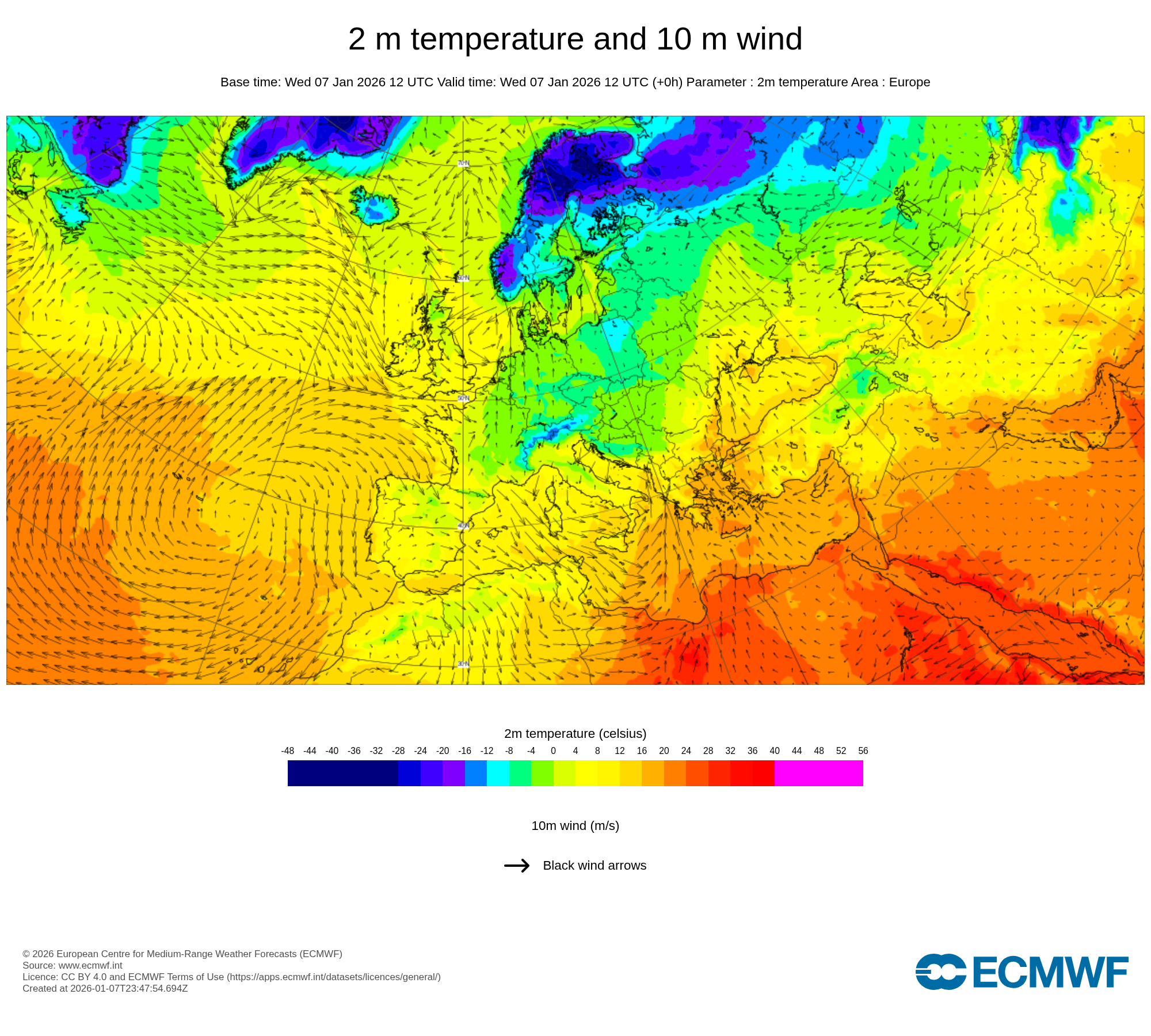

Northern Europe’s current winter disruption is no longer just a “slow terminal” story. The primary operational risk has shifted to inland evacuation capacity—rail reliability, truck appointment scarcity, and variable river/bridge conditions—raising the likelihood of extended dwell, missed cut-offs, and knock-on equipment imbalance.

This alert summarizes what matters operationally right now and what forwarders, NVOCCs, and BCOs should do over the next several business days.

What’s happening right now (the operational pattern)

Carrier and terminal updates point to the same reality: containers may be discharged, but clearing them inland is harder than normal. When inland modes lose predictability, yards densify faster, gate flows become volatile, and daily plans fail more often.

Two operational signals to treat as materially important:

- Rail disruption and irregularity (including cancellations and corridor delays), which breaks planned intermodal flows and increases rebooking cycles.

- Landside constraints (truck waiting times, appointment instability, and changing operating conditions), which limit decongestion even when quay-side work improves.

Note: Conditions are changing frequently and can vary by terminal, shift, and time of day. Plan for volatility and re-check instructions before dispatch.

Current status snapshot by major nodes (directional)

This snapshot is based on official carrier, terminal, and port notices. It is intended for planning and risk triage—not as a minute-by-minute “open/closed” statement.

Rotterdam: ECT Delta moved from stoppage messaging to “restrictions lifted,” but variability remains

- Earlier in the disruption window, industry updates flagged severe constraints at ECT Delta, including periods described as halted operations.

- ECT’s own service notifications on Jan 6–7 include multiple updates and “Restrictions lifted” notices for ECT Delta, indicating some weather-related restrictions were lifted—though conditions may still change as inland evacuation constraints persist.

- Even with restrictions lifted, recovery can be uneven if inland modes can’t clear inventory fast enough.

Operational implication: treat Rotterdam pickups and intermodal plans as “high-variance.” Confirm the latest ECT service notification before dispatch and build buffer capacity for re-booking.

Hamburg: terminal operations may continue, but inland flow remains constrained

- Carrier advisories indicate longer truck waiting times at Hamburg terminals and continued inland-side challenges.

- Expect ongoing mismatch between discharge capability and inland evacuation capacity during recovery.

Operational implication: prioritize exception management for Hamburg-import cargo (appointments, rebooking buffers, and proactive consignee communication).

Antwerp: reported slower processing, but constraints may be localized

- Carriers have reported slower processing in Antwerp alongside broader North Europe weather impacts.

- Kuehne+Nagel also noted that, at the time of its update, the Port of Antwerp had not reported any significant operational constraints—so the most accurate framing is: expect localized delays and variability, not a uniform shutdown picture.

Operational implication: use Antwerp as an option only if you can secure inland capacity on the receiving side and you can tolerate schedule variability.

Inland transport: why this is the real bottleneck

Rail: reliability loss is more damaging than pure capacity loss

When rail reliability drops, the problem is not only fewer trains—it’s the inability to plan:

- Weather-related infrastructure issues can lead to cancellations, re-timing, and missed terminal windows.

- Once a slot is missed, re-accommodation often happens in multi-day increments because the network is tightly scheduled.

- Separately from the weather event, the Hamburg–Berlin corridor has been closed for a general overhaul since Aug 1, 2025, scheduled through Apr 30, 2026, which can constrain rerouting flexibility and recovery options in parts of the network.

What this means for you: if your inland plan depends on “next-day” rail, widen delivery promise windows and pre-plan an alternative for customer-critical boxes.

Truck: appointment scarcity, queues, and winter cycle-time inflation

Even when roads are passable, winter conditions amplify friction:

- Terminals may run with reduced gate speed, creating queues and appointment churn.

- Round-trip times become unpredictable, reducing effective capacity.

- When rail is unreliable, more cargo is pushed to trucks, tightening availability and raising cost.

What this means for you: treat truck capacity as scarce for the next several days—book earlier, expect longer cycle times, and consolidate turns where possible.

Barge / river movements: bridge status can change quickly

Rotterdam’s inland waterways normally relieve pressure, but winter conditions reduce that relief:

- Port Information Notices during this period have flagged Spijkenisserbrug west side out of order (east side operational).

- Port notices also indicate Botlekbrug returned to service after a disruption in early January.

What this means for you: if you rely on barge to clear a congested yard, confirm feasibility corridor-by-corridor on the day of movement and avoid planning on “normal” cycle times.

What you should do in the next 3–5 business days

1) Triage containers by cost exposure and downstream criticality

Sort imports into three buckets:

- A: Near free-time limits / high value / customer-critical

Dispatch first, even at premium. - B: Stable buffer / flexible delivery windows

Keep planned mode but add time cushions. - C: Low urgency / can hold

Defer pickup if it prevents wasted turns—but reassess daily because yard density can change fast.

2) Shift from schedule-based planning to readiness-based planning

For each critical container, confirm:

- Terminal instruction status (gate access, restrictions, operating notices)

- Availability of a viable inland slot (truck appointment, rail booking confirmation, barge feasibility)

- A backup plan (alternative day, alternative mode, alternative depot)

If any one of those is uncertain, flag it as exception cargo and manage it actively.

3) Build a two-mode inland option where possible

When the primary inland mode is uncertain, pre-plan an alternative:

- Rail-first with truck-backup (for critical deliveries)

- Truck-first with rail-backup (if truck capacity is secured but expensive)

- Depot diversion (if consignee can accept a different inland handover point)

The goal is not optionality everywhere—it’s avoiding the worst-case: multiple failed attempts plus escalating dwell.

4) Communicate earlier and more concretely

If you manage shipper expectations:

- Provide customers a range (delivery windows may widen depending on inland slot availability)

- Explain the constraint in plain language: inland movement reliability, not only “port congestion”

- Commit to daily exception updates for A-bucket containers

What to watch (signals that conditions are improving or worsening)

Improvement signals

- Terminal notices stabilizing (fewer restrictions, consistent operating windows for multiple days)

- Rail performance improving in practice (fewer cancellations, more predictable slots)

- Gate waiting times and appointment availability stabilizing

Worsening signals

- Repeated freeze conditions causing renewed rail/road disruption

- New local restrictions on terminal access or intermittent shutdowns

- Yard density building (often reflected in stricter appointment controls and slower truck turn times)

Cost exposure: keep it defensible and practical

Winter disruptions can create a cost stack even when freight rates are stable. The key is to identify categories and decision levers—without assuming a single tariff applies to everyone.

Common exposure categories:

- Demurrage / storage (when dwell exceeds free time)

- Detention (equipment held longer than planned because return flow is disrupted)

- Extra trucking (premium rates, longer cycle time, failed turns)

- Re-handling / operational surcharges (when terminals must re-sequence or re-stack)

- Downstream impacts (missed cut-offs, production delays, DC labor rework)

Practical control levers:

- Pull forward pickups for A-bucket cargo where feasible

- Clear documentation/holds early to avoid avoidable dwell

- Consolidate pickups to reduce failed turns and idle time

- Confirm cost responsibility in your service terms and carrier notices

Operational checklist (copy/paste)

Daily

- [ ] Review carrier advisories + terminal/port notices (Rotterdam, Hamburg, Antwerp)

- [ ] Identify A-bucket containers (free time + delivery criticality)

- [ ] Confirm inland slots (truck appointments, rail bookings, barge feasibility)

- [ ] Validate terminal instructions before dispatch

- [ ] Send customer exception updates for A-bucket cargo

Before re-routing

- [ ] Confirm inland capacity and consignee flexibility at alternate gateway

- [ ] Stress-test: “What if the alternate port also slows?”

- [ ] Evaluate total landed impact (time + inland capacity + operational cost)

Bottom line

The highest risk across the North Range right now is not only crane productivity. It is inland evacuation unpredictability, which drives yard density, appointment volatility, and dwell-time escalation.

Readers who act early—by triaging exposure, securing inland slots, and planning two-mode options—can reduce the chance that a manageable delay becomes uncontrolled cost and customer-impact.

If you’d like a quick, practical walkthrough on setting up an exceptions-first workflow (milestone visibility + proactive alerts on dwell and inland-slot slippage) for North Europe imports, book a short session here.

Further Reading (Primary Sources and Official Updates)

- Maersk — Severe Winter Weather Impacting Northern Europe (Jan 7, 2026)

- Hapag-Lloyd — Expected delays at North European terminals due to weather conditions (Jan 2026)

- Kuehne+Nagel (myKN) — Winter weather causes significant disruptions across Northern Europe (Jan 2026)

- ECT (Rotterdam terminals) — Service/operational notifications (frequently updated)

- Port of Rotterdam — Port Information Notices (bridge and operational notices; search “Spijkenisserbrug” / “Botlekbrug”)

- Reuters — Dutch train traffic halted due to snow and ice (Jan 6, 2026)

Why overpay for visibility? Tradlinx saves you 40% with transparent per–Master B/L pricing. Get 99% accuracy, 12 updates daily, and 80% ETA accuracy improvements, trusted by 83,000+ logistics teams and global leaders like Samsung and LG Chem.

Prefer email? Contact us directly at min.so@tradlinx.com (Americas), sondre.lyndon@tradlinx.com (Europe) or henry.jo@tradlinx.com (EMEA/Asia)

Leave a Reply