Who Can Access the Arctic Shipping Route in 2025? A New Era of Polar Logistics

Arctic shipping has long been viewed as a distant frontier; strategically important but commercially impractical. In 2025, that perception is changing. While full-scale container trade through the Arctic is still years away, the Northern Sea Route (NSR) along Russia’s Arctic coast is no longer a speculative corridor. It’s a functional route with rising seasonal use, growing national investment, and real-world logistics implications.

Several countries, led by Russia, China, and South Korea, are actively navigating or expanding their access to the Arctic. At the same time, Western firms have largely withdrawn, creating a more regionalized, state-aligned model of Arctic logistics. This post breaks down who can access the NSR today, what’s changed in 2025, and what logistics professionals need to watch in this evolving polar theater.

What’s Changed in 2025 for Arctic Shipping?

- Record-Level Access Requests: Russia’s Rosatom, which manages the NSR, reported a 50% year-on-year increase in vessel applications for the 2025 summer–autumn window. As of May, 196 ships had applied; many of them foreign-flagged and tied to Sino-Russian trade.

- China’s Arctic Line Is Operational: NewNew Shipping, a China-based carrier, now runs a regular container service between Shanghai and Arkhangelsk. This marks one of the first recurring container lines on the NSR.

- South Korea Targets Arctic Hub Strategy: Government bodies including the Ministry of Oceans and Fisheries have launched task forces to explore Arctic logistics development, with Busan positioned as a future access point.

- LNG and Energy Flows Continue: Russia’s Sovcomflot operates a large fleet of Arctic tankers, including vessels tied to sanctioned exports. LNG projects like Yamal and Arctic LNG 2 keep NSR activity high even amid geopolitical tensions.

- Western Pullback Persists: European and North American operators remain largely absent from the NSR due to sanctions, access barriers, and elevated insurance and compliance costs.

These developments signal that Arctic logistics is shifting from trial phase to tactical deployment; but only for a select group of players operating within specific commercial and political alignments.

Who Is Actually Using the Arctic Route in 2025?

| Country | Role and Arctic Activity |

|---|---|

| Russia | Controls the NSR and regulates all foreign access via Rosatom. Actively expanding its icebreaker fleet and Arctic port infrastructure. Continues to facilitate LNG and energy exports even under sanctions. Also oversees a growing number of foreign-flagged ship applications. |

| China | Views the NSR as a core part of its “Polar Silk Road.” Operates regular service via NewNew Shipping. Doubled its Arctic voyages in 2024. Heavily invested in Arctic LNG projects and collaborates closely with Russia. |

| South Korea | Pursuing Arctic logistics strategy for Busan. The government has launched Arctic development task forces and encouraged investment in ice-class shipbuilding. Korean carriers are exploring pilot services as the season lengthens. |

| Japan | Maintains investment stakes in Russian-led Arctic LNG 2, but direct shipping involvement has declined since 2022 due to geopolitical tensions and risk exposure. |

| Western Nations | Mostly inactive on the NSR due to sanctions, commercial uncertainty, and reputational risks. Some research and coast guard presence remains (e.g., Canada, U.S.), but commercial freight access is near zero. |

This access landscape shows the NSR is becoming a geopolitically segmented route; open to select partners of Russia and China, while functionally closed to many Western operators. For freight professionals, this means Arctic opportunities depend heavily on political alignment, vessel type, and route flexibility.

What Arctic Shipping Means for Logistics Professionals

Opportunities Emerging in 2025

- Time-Sensitive Bulk and Energy Cargo: For LNG, mining exports, and project cargo tied to Russian–Asian trade, the NSR offers a faster alternative to traditional routes, saving up to 10 days in transit.

- New Routing for Niche Clients: Companies aligned with Chinese or Russian stakeholders may access seasonal Arctic windows for direct Asia–Northern Europe movements or intra-Arctic projects.

- Emerging Hub Development: South Korea’s push to develop Busan as an Arctic logistics gateway could create new feeder or consolidation nodes over the next 3–5 years.

Risks and Constraints to Watch

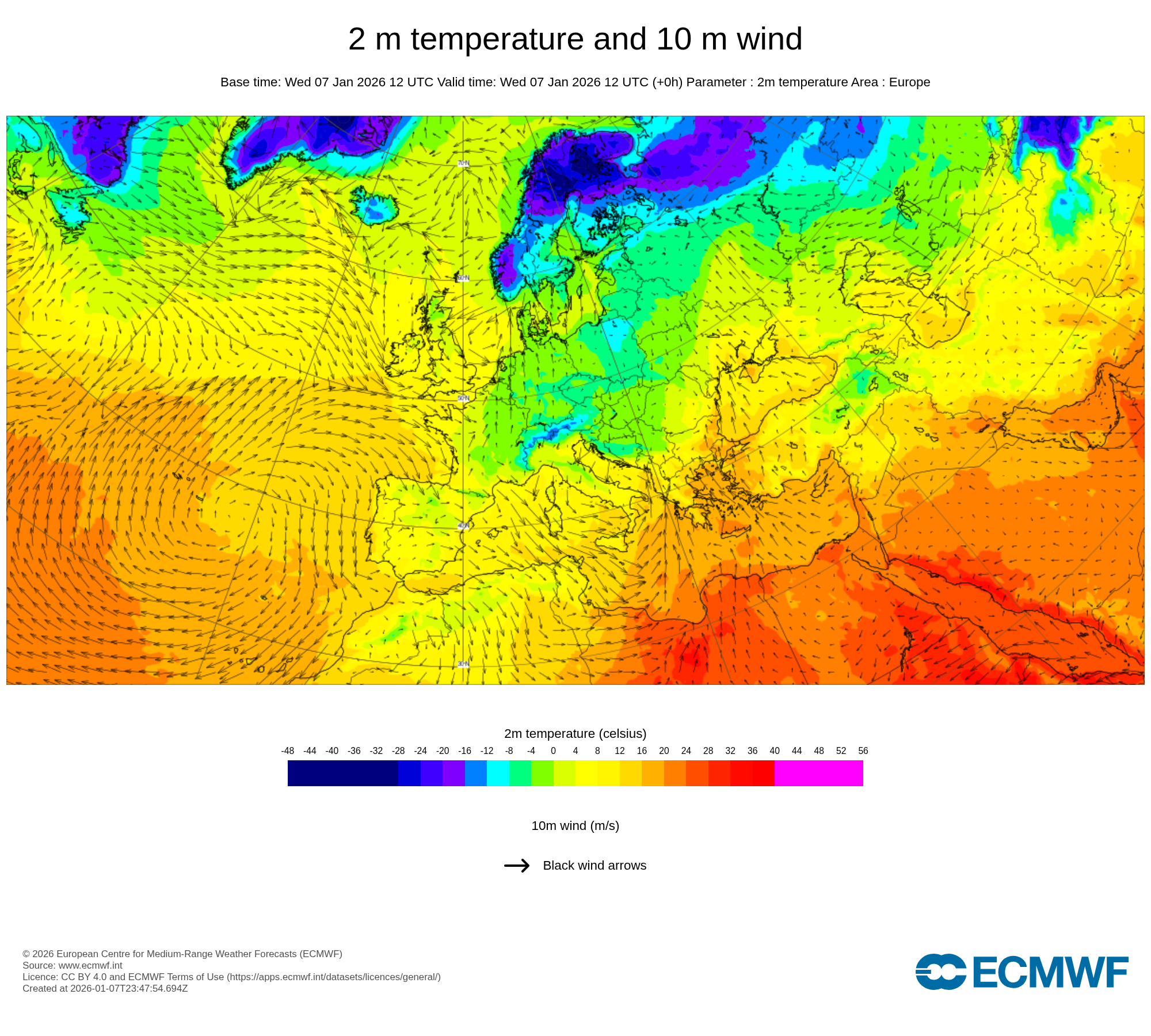

- Seasonal Windows Only: The NSR is typically navigable from July to November for standard cargo vessels. Ice-strengthened ships may stretch this window, but year-round use remains rare.

- Vessel Requirements: Operators must use ice-class ships or secure costly Russian icebreaker escorts, increasing capital and operating costs substantially.

- Geopolitical Risk: Western-aligned firms face high legal, regulatory, and insurance hurdles due to sanctions and Russian oversight of the NSR.

- Environmental Scrutiny: Arctic routes are under intense international pressure due to emissions, black carbon, and ecological risks. Major global carriers have pledged to avoid these corridors for general container trade.

Strategic Guidance for LSPs

- Evaluate Arctic routing only for high-value, bulk, or project cargo with partners who have experience operating in the region.

- Stay informed on Russian permitting protocols, insurance updates, and China’s Polar Silk Road developments.

- Model routes seasonally and factor in total cost (escort fees, weather delays, risk premiums) when advising clients.

- Monitor South Korea’s port expansion plans and technology investments in Arctic-capable shipbuilding.

In short, Arctic shipping in 2025 is a viable, but highly constrained, corridor. It is not yet a mainstream option; but for specialized clients with the right partners and vessel assets, it can serve as a tactical advantage.

Arctic Shipping Is Real, But Still Niche

Arctic shipping is no longer a theoretical possibility. In 2025, the Northern Sea Route is active, selectively accessible, and increasingly tied to the strategic ambitions of Russia, China, and South Korea. While general container shipping remains limited, energy and bulk cargo movements are growing, and infrastructure investments suggest the route will continue evolving.

That said, the NSR is still seasonal, costly, and geopolitically complex. For most logistics players, it remains a niche option, useful in specific scenarios, but not a replacement for traditional global routes like the Suez or Panama canals. Western firms in particular face access restrictions and reputational risks when engaging with Arctic corridors under Russian control.

TRADLINX enables smarter lane planning, real-time visibility, and customer-facing transparency, especially important as non-traditional routes begin to impact network design.

As interest and competition in Arctic logistics accelerate, staying informed and adaptable will separate leaders from followers.

Sources and Further Reading

- Maritime Executive: Russia Projects High Demand for Arctic Shipping

- The Diplomat: Russia’s Arctic Bet and Asia’s Role

- Korea Herald: Korea Eyes Arctic Shipping

- Reuters: Rosatom Forecasts NSR Vessel Boom

- City of Busan: Arctic Route Task Force Announcement

- High North News: South Korea’s Arctic Logistics Strategy

- Yonhap News: Oceans Minister’s Arctic Base Plans

- The Arctic Institute: Week in Review – May 2025

- Breakbulk News: Surge in Arctic Voyages

- Arctic Portal: Central Arctic Shipping Route Overview

- Seavantage: The Rise of the NSR

- The Arctic Institute: The Future of the Northern Sea Route

- Offshore Energy: Rosatom to Deploy Arctic Boxship

Frequently Asked Questions

Who is currently using the Arctic shipping route?

In 2025, primary users of the Northern Sea Route include Russian carriers like Sovcomflot, Chinese operators such as NewNew Shipping, and bulk/energy fleets tied to Arctic LNG projects. South Korean interest is rising, while most Western carriers have withdrawn due to sanctions and political risk.

Is the Arctic route faster than the Suez Canal?

Yes, for select Asia-Europe routes, the Arctic can reduce transit time by up to 10 days and cut voyage distance by 30 to 35 percent. However, this applies only to voyages during the seasonal window and often requires ice-capable vessels or escorts.

Can container ships use the Northern Sea Route?

Container use is limited. While China’s NewNew Shipping operates Arctic container service to Russian ports, there is no widespread container transit across the NSR. Most movements involve bulk or energy cargo, not general freight.

What are the main risks of Arctic shipping?

Key risks include unpredictable ice conditions, limited port and emergency infrastructure, high insurance premiums, and strict Russian oversight. Environmental scrutiny and sanctions further complicate access for many global shippers.

When will Arctic shipping become mainstream?

Experts forecast limited mainstream adoption before 2040. Seasonal access will grow, but cost, regulation, and infrastructure gaps mean Arctic routes will remain specialized for the next 10 to 15 years.

Why overpay for visibility? TRADLINX saves you 40% with transparent per–Master B/L pricing. Get 99% accuracy, 12 updates daily, and 80% ETA accuracy improvements, trusted by 83,000+ logistics teams and global leaders like Samsung and LG Chem.

Prefer email? Contact us directly at min.so@tradlinx.com (Americas), sondre.lyndon@tradlinx.com (Europe) or henry.jo@tradlinx.com (EMEA/Asia)

Leave a Reply