Importing goods can open major opportunities — but picking the wrong freight forwarder can also open a world of pain. From hidden fees to shipment delays and customs nightmares, a bad freight partner can cost you thousands and damage your business reputation.

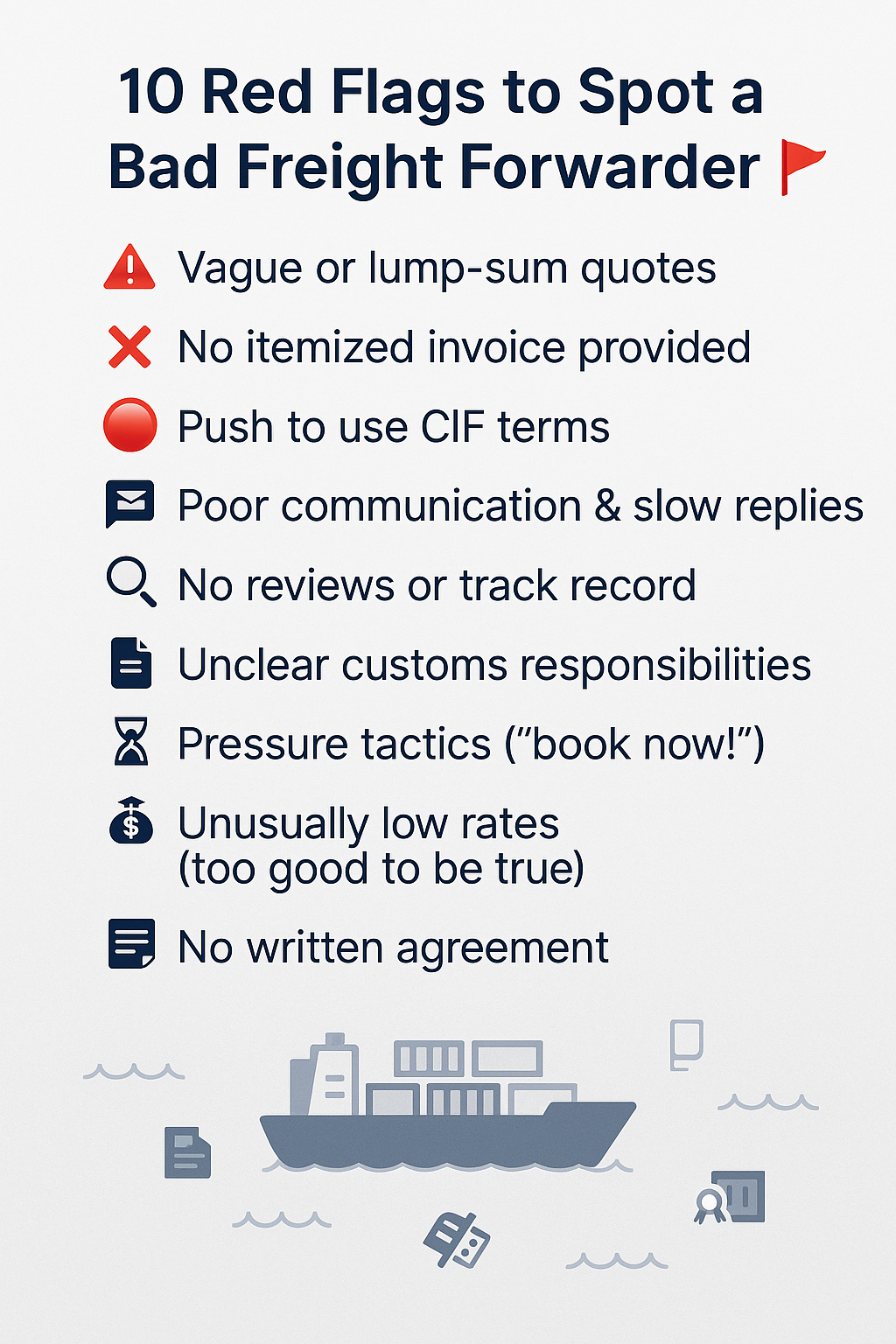

In this guide, we’ll highlight 10 major red flags to watch out for when choosing a freight forwarder — and how to avoid getting burned.

Why Picking the Right Freight Forwarder Matters

A freight forwarder doesn’t just move your cargo from Point A to Point B. They coordinate customs clearance, manage critical paperwork, ensure cargo release at destination, and control how (and when) your goods reach you.

When a forwarder fails, the consequences aren’t small:

- Surprise charges and hidden fees

- Shipment delays or port holds

- Missed delivery windows

- Extra demurrage or storage fees

- Customs clearance issues and penalties

That’s why vetting your forwarder carefully — and spotting warning signs early — is one of the smartest moves you can make as an importer.

Red Flag #1 — Vague or Lump-Sum Quotes

If a forwarder offers you a simple “all-in price” without any detailed breakdown, be cautious. Vague or lump-sum quotes are a major red flag because they often hide inflated fees that will hit you later.

A proper freight quote should clearly itemize:

- Ocean freight cost

- Terminal Handling Charges (THC)

- Delivery Order Fee (D/O)

- China Import Service Fee (CISF) if applicable

- Customs brokerage fees

- Any surcharges or extra service costs

Always request a fully itemized quote upfront. If they resist or try to delay sending it, move on to another forwarder.

Red Flag #2 — Refusal to Provide Itemized Invoices

Transparency is non-negotiable when it comes to freight forwarding. If a forwarder refuses to provide itemized invoices — before, during, or after your shipment — that’s a serious warning sign.

A reputable forwarder will always break down the charges you’re paying, including port fees, customs brokerage, fuel surcharges, and any special handling costs. Vague billing practices often mask hidden fees that weren’t disclosed upfront.

Pro Tip: Request sample invoices before you book. A legitimate forwarder won’t hesitate to show what a typical invoice looks like.

Red Flag #3 — Pushing You to Use CIF Terms

If your forwarder — or your supplier’s agent — aggressively recommends shipping under CIF (Cost, Insurance, and Freight) terms, be wary. CIF gives the seller control over the freight, including choosing the destination agent who can then tack on inflated local charges (like sky-high China Import Service Fees).

Smart importers prefer FOB (Free on Board) terms because it gives them full control over the freight and destination costs.

Always ask: “Can I ship under FOB terms and use my own forwarder?” If they hesitate, it’s a major red flag.

Red Flag #4 — Poor Communication and Delays

Early communication sets the tone for the entire shipping process. Warning signs of poor communication include:

- Slow email responses

- Incomplete or vague answers

- Unclear instructions or conflicting information

If a forwarder is hard to reach, unresponsive, or evasive before you book, imagine how they’ll behave when your shipment is in transit and problems arise.

Pro Tip: Test their responsiveness by asking a few detailed questions before booking. If you get slow, sloppy, or unhelpful replies, move on.

Red Flag #5 — No Track Record or Reviews

Choosing a forwarder with no verifiable track record is risky. Always check for:

- Client testimonials

- Third-party reviews on logistics platforms or Google

- Valid business licenses and registrations

Cheap rates are tempting, but if there’s no reputation to back them up, you could be gambling with your shipment. A legitimate forwarder will have a history you can verify.

Red Flag #6 — No Clear Responsibility on Customs

Good forwarders make customs handling crystal clear. Watch out if a forwarder is vague about:

- Who files the customs entry

- Who pays duties and taxes

- Who arranges brokerage services

Customs mistakes can cause expensive delays, fines, or even cargo holds. Always confirm who is responsible — in writing — before you ship.

Red Flag #7 — Pressure Tactics (“Book Now or Lose Space!”)

Urgency can be real during peak shipping seasons, but beware of forwarders who use aggressive pressure tactics year-round. Phrases like:

- “You must book today!”

- “Prices double tomorrow!”

- “No time to explain, trust me.”

are designed to push you into rushed decisions. Reputable forwarders will give you realistic deadlines — not scare tactics.

Red Flag #8 — Unusually Low Rates

If a freight quote looks too good to be true — it probably is. Unusually low rates often hide:

- Excessive destination charges

- Excluded services like documentation or customs clearance

- High storage or demurrage penalties after arrival

Benchmark typical rates with at least two or three forwarders. If one quote is suspiciously lower without explanation, that’s a huge red flag.

Red Flag #9 — No Written Agreement

Never ship based on verbal promises. Every freight booking should include a written agreement that clearly spells out:

- Scope of services

- Full breakdown of charges

- Incoterms and delivery terms

- Free storage days and potential extra charges

Without a written contract, it’s almost impossible to dispute unfair charges later. Protect yourself by insisting on clear documentation upfront.

Red Flag #10 — No Clarification on Storage and Demurrage

Storage and demurrage fees can escalate quickly if you don’t clarify:

- How many free days are included at the destination port

- When demurrage starts

- How much per day after free time expires

A good forwarder will be upfront about these risks and help you avoid costly surprises. If they dodge your questions — be cautious.

Why overpay for visibility? TRADLINX saves you 40% with transparent per–Master B/L pricing. Get 99% accuracy, 12 updates daily, and 80% ETA accuracy improvements, trusted by 83,000+ logistics teams and global leaders like Samsung and LG Chem.

Prefer email? Contact us directly at min.so@tradlinx.com (Americas) or henry.jo@tradlinx.com (EMEA/Asia)

Leave a Reply