Ongoing strikes in southern Italy and post-cyclone congestion across Sri Lanka and southern India are causing significant logistics delays, with ripple effects across transshipment networks and inland distribution.

1. Italy Port Strikes Expand: Naples and Salerno Hit by Trucking Disruptions

Current Situation:

Unannounced and escalating trucker strikes are disrupting operations at Naples and Salerno, two key Mediterranean ports. The action began on 1 December in Naples and escalated to Salerno on 3 December, according to operational advisories. Unlike earlier, scheduled labor actions, this wave of strikes stems from grassroots frustration over unresolved road congestion and poor inland connectivity.

What’s Affected:

- Container gate-in/out delays across both ports

- Feeder services on Europe-Asia routes facing unpredictable delays

- LCL and time-sensitive cargo (especially perishable and automotive) most impacted

- Trucking coordination disrupted beyond port zones due to cascading congestion

What to Watch:

- December 9–24: Italy’s nationwide transport and logistics strike calendar includes:

- Dec 9–11: National ferry stoppages

- Dec 12: General strike (freight, ports, rail)

- Dec 17: Aviation sector actions

- Dec 22–24: National freight logistics strikes

Expect cumulative disruption across inland trucking, feeder reliability, and port-side availability throughout December. Rerouting via Genoa, Trieste, and North Europe may offer temporary relief — though congestion at Antwerp and Rotterdam remains high.

2. Post-Cyclone Congestion Persists at Colombo and South Indian Ports

Current Situation:

After Cyclone Ditwah forced temporary shutdowns at Colombo & Kattupalli shutdowns + partial disruptions at Chennai/Ennore, operations have resumed — but at reduced efficiency. As of early December:

- Colombo Port:

- Vessel queues: 13+ ships, average 2-day wait

- Transshipment delays impacting Far East–Europe and Middle East–US lanes

- Kattupalli & Chennai:

- Inland congestion, water damage to approach roads

- Minimum productivity (around 12–13 moves/hour)

- CFS staffing operating at ~65%, causing backlogs for LCL cargo

What’s Affected:

- Transshipment-dependent shipments through Colombo (Asia-Europe routes)

- Peak-season sailings and container bookings into December 3rd and 4th weeks

- CFS handling and customs clearance for southern India import/export cargo

What to Watch:

- Residual congestion at Colombo expected through mid-December

- Container tracking and event-level visibility is essential as schedules shift and rerouting decisions emerge

- Consider alternate routings via Singapore or JNPT/Kakinada, where capacity permits

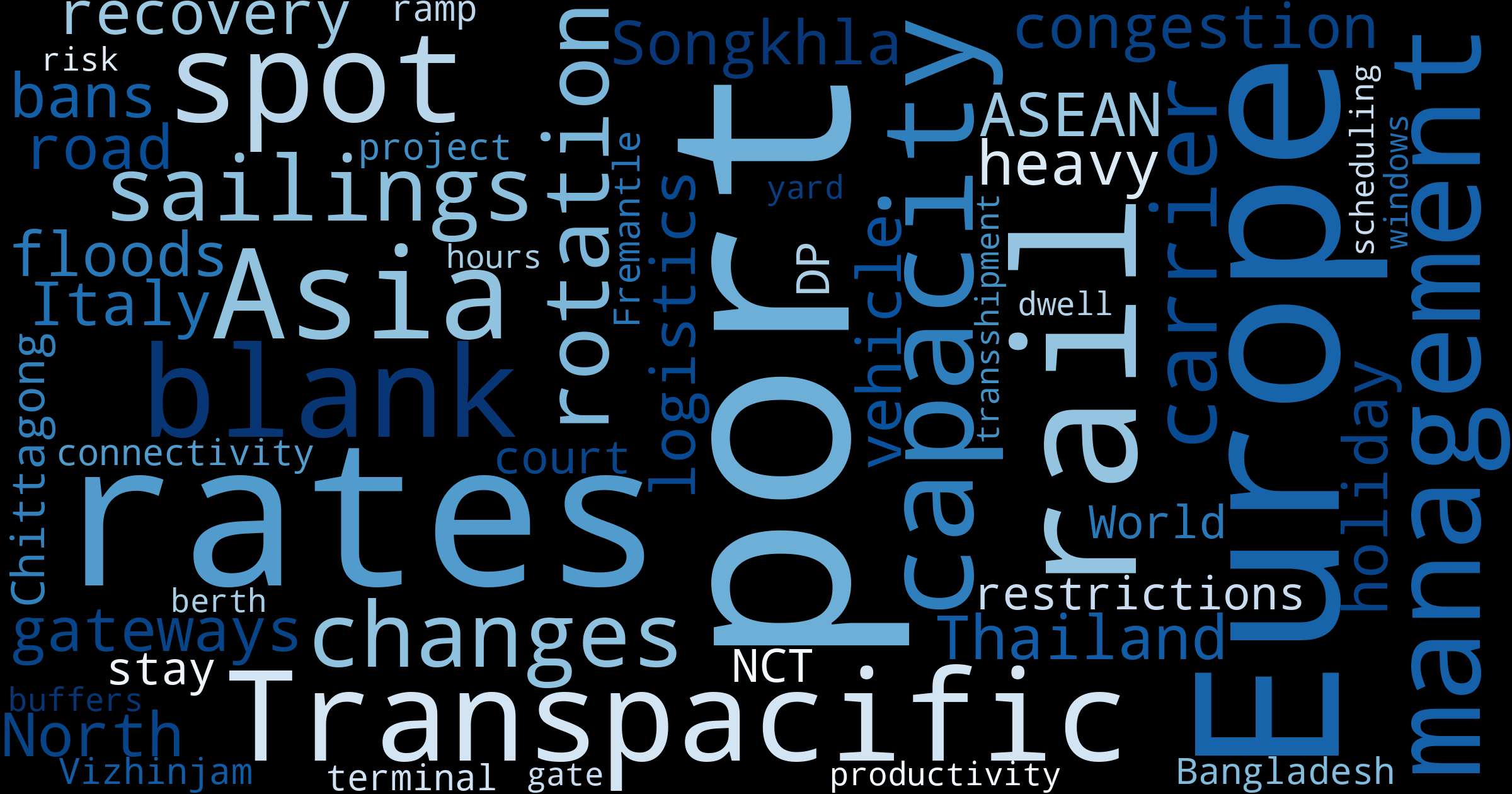

TRADLINX Insight: Why Visibility Matters Now

December is peak-risk season. These layered disruptions show how port status alone doesn’t reveal the full risk — it’s the landside, CFS, and trucking bottlenecks that compound delays.

With TRADLINX’s multi-carrier visibility, logistics providers can:

- Track container delays across Europe-Asia routes

- Monitor dwell time spikes at Colombo and Naples

- Share real-time status with customers via white-labeled portals

- Detect rerouting patterns early to reduce detention fees

Key Takeaways for LSPs and Forwarders

- Italy’s strikes are not isolated events — they’re part of a broader December logistics slowdown

- Cyclone recovery in South Asia is slower than official reopening suggests — container-level tracking is critical

- Plan around bottlenecks, not just port names: trucking, CFS, and gate access are the chokepoints

Monitor these developments daily, and stay agile — congestion in one hub often reroutes risk to another.

Further Reading

- myKN: Port operational updates – Naples and Salerno

- Reuters: Italy’s largest union calls general strike for December 12

- Reuters: Transport in Italy disrupted by strikes against PM Meloni

- Reuters: Sri Lanka grapples with trauma, loss after deadly cyclone Ditwah

- WHO: Sri Lanka Flash Update on Cyclone Ditwah, December 2, 2025

- Port Congestion Risk Outlook – December

Leave a Reply